It’s tax season, which means you can’t be lax when it comes to protecting your personal information. While identity theft and Internet scams can occur at any time, the amount of sensitive information being shared online increases during certain times of the year, prompting additional efforts from cybercriminals to steal your information.

The Consumer Sentinel Network Data Book, aggregated annually by the Federal Trade Commission (FTC), found that 2.4 million fraud reports filed in 2022 resulted in $8.8 billion in total fraud losses for that year. Every year, the Internal Revenue Service (IRS) releases a list of known tax scams and how to avoid them as a resource for taxpayers to remain aware of as they prepare their tax returns. In 2023, scams targeting educational institutions and phishing emails impersonating university HR/payroll departments through IRS impersonation email scams were on the rise. IRS impersonation phone scams have also increased.

If you’re unsure if a communication is legitimate, this list of tips can help you tell if it is really the IRS contacting you. The following helpful hints will aid you in protecting your personal information.

- Create unique, strong passwords.

A password acts as a shield around your personal information, so you want to make sure it is secure. Your password should be long, difficult to guess, and include letters, numbers, and symbols, especially for any financial sites such as online banking accounts. It’s important to change your passwords regularly and only use secure methods of storing your passwords. Not sure where to begin? Explore how to build a strong password through this infographic. - Enable multi-factor authentication.

Using multi-factor authentication, also known as two-step login, for your personal accounts increases account security. With multi-factor authentication, you’re required to provide another form of identification, such as a passcode provided by email or text, to verify your identity. This is beneficial for financial accounts, social media, email, or any other accounts containing personal information. Also, beware of cybercriminals creating fraudulent Duo alerts in an attempt to access your passwords and accounts. Know what to look out for and avoid this scam through this infographic. - Stay protected with antivirus software.

Using antivirus software blocks hackers from accessing your information. To better protect your devices, check out the antivirus software options offered to Rutgers faculty, staff, and students for both university-owned and personal equipment. - Beware of phishing.

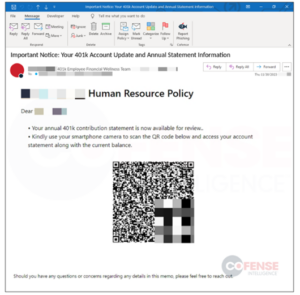

Phishing refers to fraudulent messages commonly delivered via email, text messages (smishing), phone calls, and other forms of online communication, that are sent to steal someone’s personal information by impersonating a legitimate source. Most companies, especially accounting firms, won’t ask you to supply personal or financial information through insecure methods like email, text, or social media. If you’re unfamiliar with phishing, learn what signs to look out for and how to steer clear of phishing scams through our informative infographic. - Keep your social security number safe.

Since the IRS uses social security numbers to identify taxpayers, keep your card home in a safe place, and never share your number via email, phone, or social media. Learn how to avoid Social Security-related scams through the Social Security Administration website.

How to report tax scams and fraudulent schemes

IRS: The IRS does not initiate contact with taxpayers via text message, email, or social media channels to request financial and/or personal information. To report suspected scams, visit the IRS website to review established reporting protocols. You can also reach out to the Treasury Inspector General for Tax Administration at 800-366-4484.

University: Report suspected scams to abuse@rutgers.edu, as well as to your manager or dean. It is important to learn how different departments will interact with you relative to your personal or financial information. For example, you will not be asked to provide your Social Security Number via email to get assistance from Human Resources or Payroll. Also, W-2 form requests are managed via the University portal – myRutgers Portal. When in doubt, verify!

Below is an example of a phishing scam that a staff member could receive.